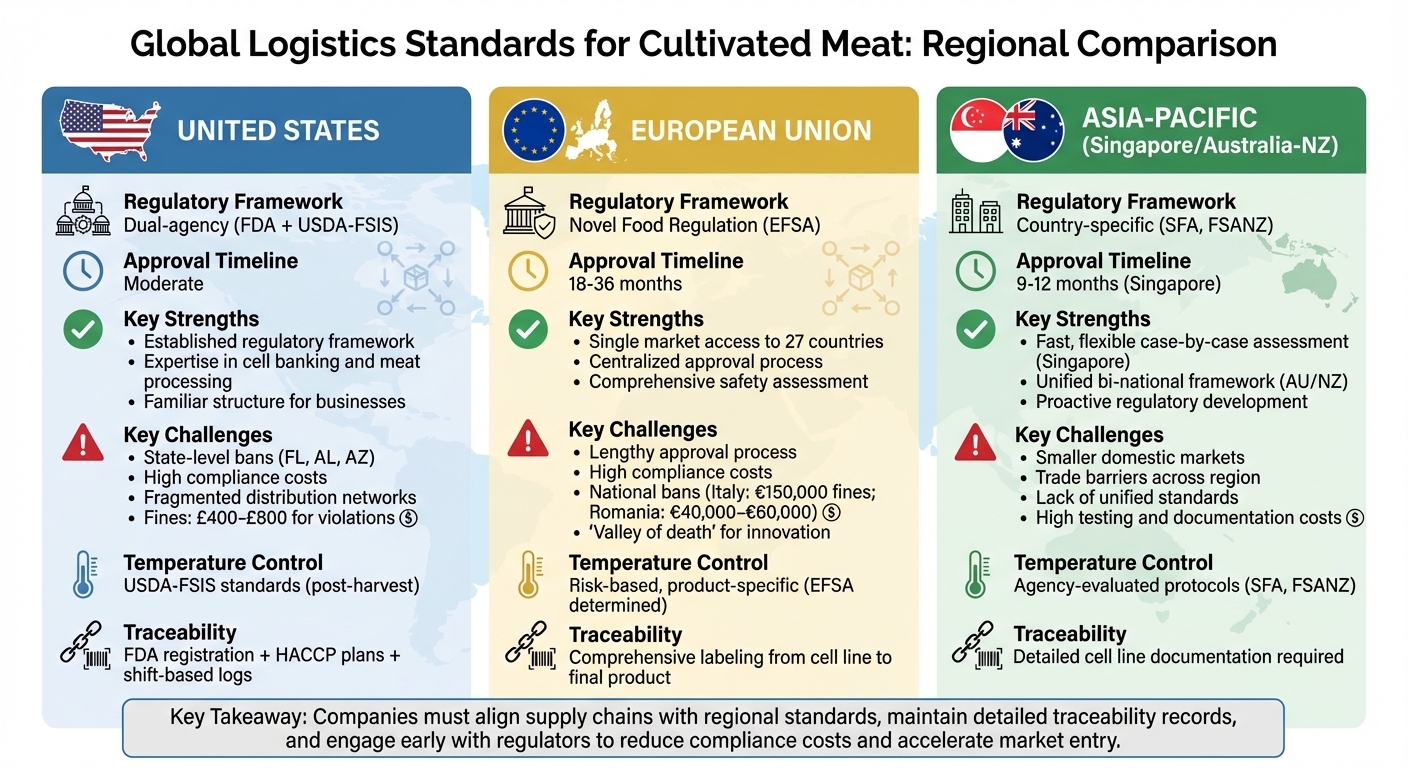

Transporting cultivated meat presents unique challenges due to varying global regulations and safety requirements. Key factors like temperature control, traceability, and customs compliance differ across regions, impacting logistics costs and timelines. Here's a quick breakdown:

- United States: Dual-agency regulation (FDA and USDA). Strict temperature control, detailed traceability, and state-level bans complicate logistics. Approval is moderate in speed but costly.

- European Union: Novel food classification with a centralised approval process. Access to 27 member states once approved, but the process is lengthy (18–36 months) and expensive. National bans in some countries add complexity.

- Asia-Pacific: Singapore leads with fast approvals (9–12 months) and tailored safety measures. Australia and New Zealand share a unified framework but face extended timelines due to public consultations. Trade barriers remain a challenge across the region.

Quick Comparison:

| Region | Strengths | Challenges | Approval Timeline |

|---|---|---|---|

| United States | Established regulatory framework | State-level bans, high compliance costs | Moderate |

| European Union | Single market access to 27 countries | Long approval process, national bans | 18–36 months |

| Asia-Pacific | Singapore's fast, flexible system | Trade barriers, smaller markets | 9–12 months (SG) |

Understanding these differences is critical for businesses aiming to distribute cultivated meat globally. Companies must align with local standards, maintain detailed records, and navigate complex trade requirements to ensure compliance.

Global Cultivated Meat Logistics Standards Comparison by Region

2023 State of the Industry: Cultivated meat and seafood

sbb-itb-ffee270

1. United States Logistics Regulations

The United States has a dual-agency system for regulating logistics, dividing responsibilities between the FDA and USDA-FSIS. This framework directly impacts how temperature control, traceability, and tariffs are managed across the supply chain. The FDA oversees the preharvest phase, which includes cell collection, banking, and cultivation until the biomass is harvested from bioreactors. At that point, jurisdiction shifts to the USDA's Food Safety and Inspection Service (FSIS), which governs standards for terrestrial meat and poultry[5][8].

Temperature Control Standards

Once harvested, cultivated meat must meet the same safety and handling requirements as conventional meat[6]. This means that temperature control during storage and transportation falls under USDA-FSIS regulations, as outlined in the Federal Meat Inspection Act (FMIA) and the Poultry Products Inspection Act (PPIA)[8]. FSIS also mandates that inspection personnel monitor operations at least once per shift[9][7].

Traceability Requirements

Facilities involved in producing cultivated meat must register with the FDA and maintain a written food safety plan, which includes hazard analysis and preventive controls. Once the biomass is harvested, a Grant of Inspection must be obtained from USDA-FSIS, and operators must implement HACCP plans with records maintained on a shift-by-shift basis[7][10][9]. To streamline oversight, the FDA shares premarket consultation dossiers with USDA-FSIS. Additionally, labels for these products must be pre-approved by the FSIS Labelling and Programme Delivery Staff and must clearly indicate that the product is cultivated meat[5][8]. This detailed traceability process plays a key role in navigating the challenges of customs and tariffs.

Customs/Tariffs

For foreign exporters, gaining access to the U.S. market requires that their regulatory systems are deemed equivalent by FSIS[9][7]. This process involves comprehensive audits of the exporting nation's regulatory framework, creating a non-tariff barrier to trade. Once equivalency is confirmed, the country must be listed in the FSIS Import Library by species. U.S. exporters, on the other hand, must use the Public Health Information System (PHIS) to obtain export certification, following the FSIS 9000 series directives[9]. These requirements add another layer of complexity to compliance.

Compliance Costs

Meeting the dual-agency requirements comes with significant costs. Companies must maintain shift-based PHIS logs, secure pre-approved labels for every product, and navigate complex regulatory frameworks[9]. Infrastructure also presents a challenge - achieving price parity with traditional meat may require substantial upgrades, such as larger bioreactors and greater automation. As Sarah Baig, Undersecretary for Research, Education, and Economics at USDA, remarked:

Cellular agriculture really fits into USDA's vision for the future of food and our agricultural systems[4].

2. European Union Logistics Standards

The European Union (EU) categorises cultivated meat as a novel food, meaning it must undergo a centralised pre-market safety assessment by the European Food Safety Authority (EFSA) under Regulation (EU) 2015/2283. The EU adopts a precautionary principle during risk assessments, tailoring temperature control and traceability requirements for each product. These specifics are outlined in the product’s authorisation on the Union List of Novel Foods [11]. This flexible, risk-based method contrasts with the more rigid, prescriptive approach used in the United States. The approval process usually takes around 18 months, but this can stretch to three years if additional data is required [11].

Temperature Control Standards

EFSA determines logistics and temperature control standards for cultivated meat products during its risk assessments [11]. All products must adhere to the General Food Law (Regulation (EC) No 178/2002), which prohibits the sale of unsafe food [11]. If there is ongoing scientific uncertainty about a product's safety, temporary measures - such as strict storage and transport conditions - can be imposed under the precautionary principle.

Traceability Requirements

Manufacturers are required to provide comprehensive labelling that covers every stage of production, from the identity of the cell line to the maturation process using advanced production systems. This ensures full traceability and helps consumers understand the product’s origin and nutritional details [1]. These labelling rules are specified in the product’s authorisation to guarantee transparency [12].

In July 2024, the French company Gourmey became the first to submit a regulatory application for cultivated foie gras to the European Commission. This case is expected to serve as a significant test for the EU’s framework [11][13].

Customs and Tariffs

National trade policies within the EU add further complexity to logistics. For instance, some countries have introduced bans that create legal challenges for international exporters. Italy’s Law No. 172 (December 2023) imposes fines of up to €150,000, while Romania has proposed legislation with penalties ranging between €40,000 and €60,000. Exporters must also ensure their packaging and documentation comply with the EU’s strict labelling rules.

Compliance Costs

Navigating the novel food authorisation process can be expensive, as it requires detailed dossiers on safety, nutrition, and hygiene. Utilizing food-safe ingredients can help streamline these requirements while managing costs. This poses a significant challenge for smaller companies. Francesca Carantoni from Maastricht University has remarked:

The EU's pathway is slow and costly, sometimes described as a 'valley of death' for innovation, especially given the absence of direct financial incentives [13].

However, there are signs of progress. In July 2024, Poland’s LabFarm Sp. z o.o. secured a grant of approximately €2 million from the National Centre for Research and Development. This marked the first instance of direct public investment in cultivated meat research and development by a Central and Eastern European government.

3. Asia-Pacific Logistics Frameworks

The Asia-Pacific region is steadily shaping its approach to regulating cultivated meat, with countries adopting a variety of frameworks. By late 2025, only Singapore and Australia had approved cultivated meat for commercial sale within the region, while the United States serves as a global reference point for regulatory standards [6].

Temperature Control Standards

Efforts are underway, led by the APAC Regulatory Coordination Forum, to create unified standards for documentation, traceability, and trade requirements across the region [3]. National agencies like Singapore's Food Agency (SFA) and Food Standards Australia New Zealand (FSANZ) play a vital role in evaluating storage and transport protocols. A case in point: in 2025, FSANZ approved Sydney-based Vow's cultivated quail after a six-week public consultation, setting an important precedent for safety standards in the region [4][6].

Traceability Requirements

Traceability in the Asia-Pacific market relies heavily on detailed cell line documentation. This documentation ensures safety throughout the production process - from cell isolation to the final product [3]. Companies must provide comprehensive data on cell sourcing and characterisation to secure pre-market approvals. For example, in 2025, GOOD Meat gained approval in Singapore to use serum-free media in its cultivated chicken production. This milestone required extensive documentation to meet SFA's traceability standards [6].

South Korea has also updated its Food Sanitation Act to officially classify cultivated meat as an ingredient, introducing specific pre-market requirements [4]. Meanwhile, Japan is navigating a dual-agency oversight system involving the Ministry of Health, Labour and Welfare and the Consumer Affairs Agency, requiring companies to liaise with both agencies for regulatory compliance [4].

As Mirte Gosker, Managing Director of GFI APAC, remarked:

Japan and South Korea will likely be next in line among APAC countries to develop such frameworks, as both nations are proactively seeking input from industry groups to craft clear and efficient safety review processes. [4]

This focus on rigorous documentation highlights the region's commitment to establishing robust safety standards.

Customs and Tariffs

Trade and tariff challenges add another layer of complexity to the regulatory landscape. The lack of clear international standards for product classification creates significant hurdles for moving cultivated meat between Asia-Pacific countries and global markets [3]. Sourcing and characterisation of animal cells remain particularly uncoordinated, further complicating trade. To address this, over 30 companies have signed an MOU agreeing to standardise the term "cultivated meat", aiming to simplify consumer communication and reduce trade barriers [6]. However, these unresolved trade issues continue to increase compliance burdens.

Compliance Costs

The varying food safety regulations across the region significantly drive up compliance costs. Companies must invest heavily in advanced testing, quality assurance, and robust documentation systems to meet these demands [14]. For guidance, many industry professionals turn to Cellbase, which offers insights and procurement solutions tailored to these stringent requirements.

The lack of unified standards forces companies to develop extensive toolkits for cell line documentation to navigate the inconsistencies [3]. Israel, responsible for 15% of global investments in cultivated meat, has emerged as a strategic partner in helping shape regulatory frameworks in the region [4]. Additionally, the UK is exploring a bilateral agreement with Israel to expedite cultivated meat approvals, potentially offering a model for Asia-Pacific countries looking to streamline their own processes [4].

Advantages and Disadvantages

This section breaks down the regulatory benefits and challenges specific to each region, focusing on their impact on cultivated meat logistics.

Each region has its own set of strengths and hurdles when it comes to regulations for cultivated meat. In the United States, the regulatory framework benefits from the expertise of the FDA and USDA in cell banking and meat processing, which provides a familiar structure for businesses to navigate [15]. However, state-level bans in places like Florida, Alabama, and Arizona create fragmented distribution networks. Violating these bans can result in fines ranging from £400 to £800 [4]. This fragmented approach complicates interstate transport, even when federal approval is in place.

In the European Union, once approval is granted, products gain access to all 27 member states, offering expansive market potential [5]. However, the bloc’s precautionary stance means higher costs and approval processes that can take 18 to 36 months, delaying market entry significantly [15][5]. Additionally, national bans in countries like Italy and France add another layer of complexity to logistics planning across the region [17].

Singapore stands out for its efficient and flexible regulatory system. The Singapore Food Agency often completes approvals within 9 to 12 months, using a case-by-case safety assessment approach [5]. This allows for tailored logistics requirements rather than rigid standards. However, Singapore’s small domestic market limits the scale of its logistics infrastructure compared to larger markets like the US or EU. On the other hand, Australia and New Zealand benefit from a shared Food Standards Code, which ensures consistent handling standards across both nations [5]. While this unified framework is advantageous, the statutory assessment process often includes public consultation periods, which can extend timelines.

Here’s a quick comparison of regional advantages and challenges:

| Region | Key Advantage | Primary Disadvantage | Approval Timeline |

|---|---|---|---|

| United States | Established FDA/USDA frameworks leveraging cold-chain expertise [15] | Fragmented distribution due to state-level bans (FL, AL, AZ) [4] | Moderate |

| European Union | Single market access to 27 countries once approved [5] | Lengthy approval process (18–36 months) and high costs [15][5] | 18–36 months |

| Singapore | Fast, flexible case-by-case assessment [5] | Small market limits logistics infrastructure scale | 9–12 months [5] |

| Australia/New Zealand | Unified bi-national framework via Food Standards Code [5] | Statutory assessment includes public consultation periods | Moderate |

These regional comparisons highlight the financial and operational challenges companies face when entering these markets. For example, the EU’s detailed documentation requirements add to compliance costs, while the US demands significant investment in logistics infrastructure [4]. This includes optimizing bioreactor cultivation costs to maintain margins while meeting strict regional standards.

Understanding these regulatory differences is crucial for building adaptable and compliant supply chains. Companies like Cellbase provide procurement solutions tailored to meet the specific standards of each region, helping businesses source the right equipment and materials to ensure compliance across diverse jurisdictions.

Conclusion

Looking at the regulatory landscapes discussed above, it’s clear that navigating regional differences calls for tailored supply chain strategies. For example, the United States relies on a dual-agency system, while the European Union's Novel Food Regulation provides access to 27 member states, albeit with longer approval processes. Meanwhile, Singapore's more flexible approach has allowed quicker market entry.

For companies venturing into these markets, establishing strong food safety systems is a top priority to address hazards along the supply chain [2]. Maintaining detailed traceability records and ensuring labelling complies with local regulations are equally critical [8]. Engaging with regulators early - through initiatives like Singapore's Virtual Clinics or the UK's Cell-Cultivated Products sandbox (scheduled from February 2025 to February 2027) [16] - can help reduce compliance costs and speed up market entry. Another challenge is sourcing specialised inputs across different regulatory regions. Platforms such as Cellbase assist cultivated meat companies by linking them with verified suppliers familiar with local compliance needs, helping to simplify procurement.

Building supply chains that align with diverse regional standards is essential for scaling globally. As regulations continue to shift, having flexible logistics systems and dependable sourcing networks will be crucial for the cultivated meat industry's long-term growth. These adaptable and compliant supply chains will serve as the foundation for successful global expansion.

FAQs

What approvals are needed before shipping cultivated meat into the US, EU or Singapore?

Shipping cultivated meat comes with the challenge of meeting regulatory requirements in each region. In the United States, this involves approvals from both the USDA and FDA, with safety inspections guided by HACCP principles. In the European Union, products are assessed under the Novel Food Regulation, which requires a detailed safety evaluation. Meanwhile, Singapore insists on regulatory approval, including rigorous safety evaluations and licensing. These processes are in place to ensure that all products meet strict safety and inspection standards before they can enter the market.

How do temperature-control rules differ for cultivated meat across these regions?

Temperature-control rules for cultivated meat differ depending on the region. In the EU, cultivated meat falls under the category of novel food, which means it must adhere to strict temperature guidelines during both production and storage to ensure it remains safe for consumption. Similarly, in the US and UK, food safety regulations highlight the importance of temperature controls as a key part of preventing hazards. While specific approaches may vary, all regions share a common focus: maintaining proper temperature management to avoid contamination and uphold food safety standards.

What traceability records are required to pass audits and clear customs?

To successfully navigate audits and customs clearance for cultivated meat, it's crucial to maintain thorough traceability records. These records should detail everything from the origin of raw materials - like cell lines and growth media - to the manufacturing processes, including batch records, process controls, and hygiene protocols. Additionally, they must include data on testing, such as pathogen checks, chemical analyses, and stability assessments.

It's also important to keep a well-organised archive of regulatory approvals, certifications, and audit reports. These documents help prove compliance with both local and international standards, such as HACCP guidelines in the UK or USDA/FDA regulations in the US. Without this level of documentation, meeting regulatory and customs requirements becomes significantly more challenging.